Growth in global air traffic – June breaks records

For the first time, the number of worldwide flights in June exceeded the three million planned take-offs mark – an increase of 3.5 percent compared to the previous year. This is one of the findings in the latest Global Aviation Monitor. Researchers at the German Aerospace Center (Deutsches Zentrum für Luft- und Raumfahrt; DLR) regularly monitor more than 3500 airports and 850 airlines to determine current trends in global air traffic.

The full report can be found here.

Global growth

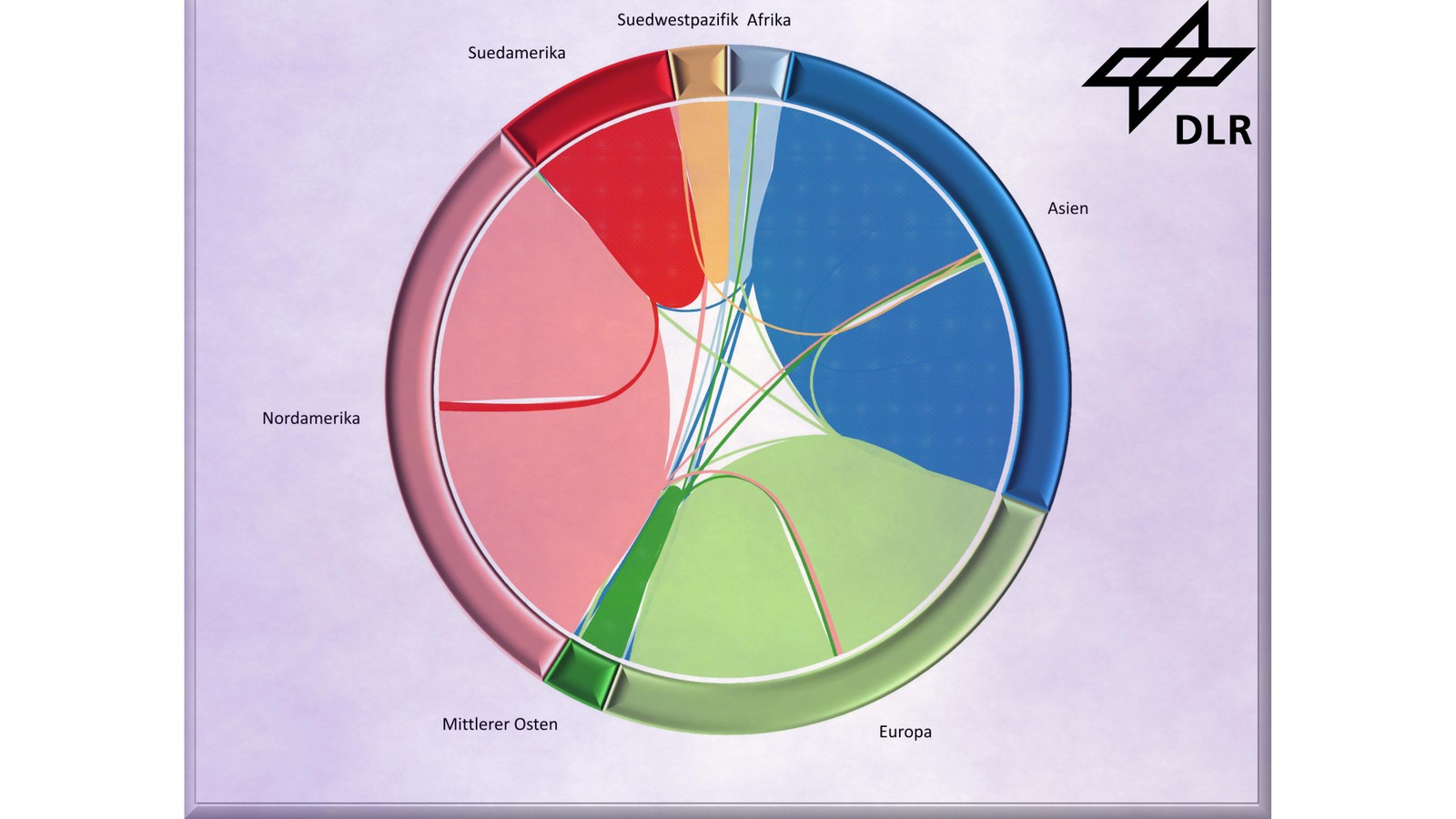

Following years of decline and stagnation, the number of flights in North America has once again increased by one percent compared to the previous year. With over 880,000 flights per month, North America continues to be the biggest market in the world for air traffic, handling approximately 30 percent of global air traffic. In second place is Asia with an overall share of 27 percent of global air traffic due to an increase of between five and 10 percent in recent years. Europe is in third place, with 750,000 take-offs per month. The European market grew between three and five percent monthly on average over the last year. Germany is following the global trend in growth too – 85,000 take-offs in June represents an increase of 3.6 percent compared to June 2015.

Flight volume is expected to increase between two and four percent in the third quarter of 2016 – in Europe and worldwide.

Over one third more flights in Berlin-Schönefeld

One airport is particularly benefiting from the global trend. In June 2016, Berlin-Schönefeld Airport handled 35 percent more flights than in the previous year. This growth is primarily due to the significant increase in Ryanair offerings. Cologne-Bonn Airport is also benefiting from the Irish low cost carrier’s offensive.

But a negative trend is seen at smaller airports such as Dortmund and Frankfurt-Hahn. The retreat of Air Berlin and other airlines from smaller airports has led to shrinking flight numbers. "We have noticed that low cost carriers are increasingly focusing on larger locations and withdrawing more and more from the small airports," explains Peter Berster from the DLR Institute of Air Transport and Airport Research.

"With regard to destinations, in recent months, we have noticed an almost 30 percent decline of air traffic from Germany to Africa," adds Basher.

Low cost carriers gain ground across the world

When measuring by the number of flights, American Airlines is the biggest carrier in the world. With the takeover of US Airways, this year the North American company is offering 85 percent more flights than in the previous year – 200,000 flights in June 2016 alone. On the other hand, real growth without the acquisition of competitors is observed in some low cost carriers such as Ryanair and Indian airline IndiGo. Amongst the five largest airlines in the world, two are now low cost carriers – Southwest and Ryanair – in addition to US airlines from three major air transport alliances: Oneworld, SkyTeam, and StarAlliance.

Inexpensive European flight market

Two low cost carriers are also the top airlines in Europe with the most flight offerings. While several traditionally large airlines such as SAS, Air France, and Aeroflot have reduced their range, Ryanair has increased its offer of flights across Europe by 10 percent to around 59,000 take-offs. By comparison, Easyjet has 45,000 flights per month, Lufthansa 41,000 and Turkish Airlines 36,000. In Germany, Lufthansa continues to be the undisputed number one with 27,500 take-offs, followed by Air Berlin with 12,000, and Germanwings/Eurowings with approximately 10,000 take-offs.

Despite Ryanair's strong growth of over 36 percent in Germany compared to the previous year, the number of flights in the country remains relatively low – at 3700 take-offs. Lufthansa is also aligning itself strategically with the low cost flight tickets business. With the exception of flights to and from its hubs in Frankfurt and Munich, Lufthansa has transferred all its domestic and European flights to its subsidiary Germanwings in recent years. The long-haul low cost carrier Eurowings, which also belongs to the Lufthansa group and into which all Germanwings flights are expected to be integrated in future, has been in existence since 2015. Noticeable in the German market is the strong growth of low cost carrier Transavia, a subsidiary of KLM/Air France, which is now offering flights within Germany on the Munich-Berlin route with the launch of the 2016 summer timetable this June.

Global Aviation Monitor

The Global Aviation Monitor (GAM) is published quarterly by the DLR Institute of Air Transport and Airport Research. The report sets out the current situation of international, European, and German air transport and offers a short-term forecast for the following three months. It provides stakeholders in the air transport market with early notice of changes in the global air transport sector.